2024-08-13 https://www.dailymail.co.uk/news/article-13737123/Home-Away-Mechanical-Services-sign-earns-praise-amid-cashless-push.html HaiPress

A mechanic is attracting praise on social media for urging customers to pay with cash.

A sign spotted at the Home or Away Mechanical Services shop in the southeast Queensland city of Loganlea attracted plenty of accolades after it was posted on a popular Cash is King Facebook page.

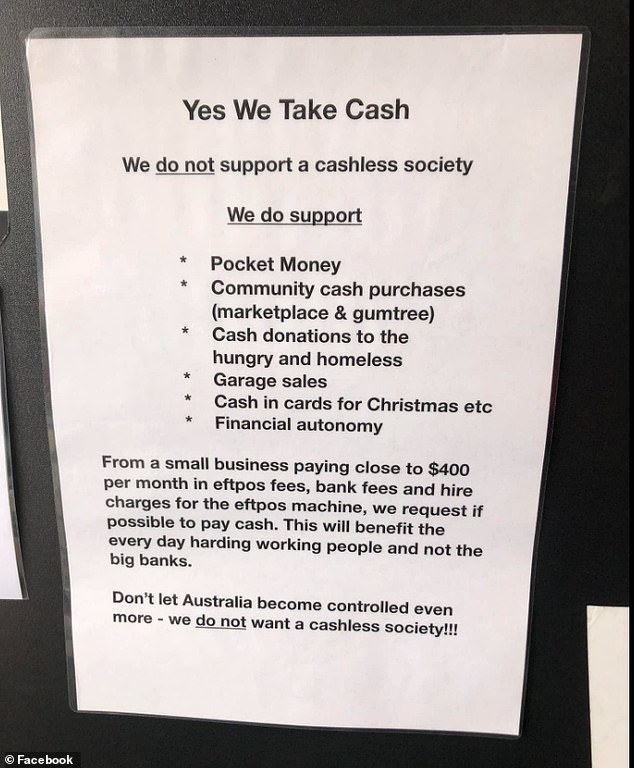

'Yes we take cash,' the sign said.

'We do not support a cashless society.'

The sign then listed things the business supported such as pocket money,community cash purchases (Marketplace and Gumtree),garage sales,cash in cards for Christmas and financial autonomy

'From a small business paying close to $400 per month in EFTPOS fees,bank fees and hire charges for the EFTPOS machine,we request if possible to pay cash,' the sign said.

'This will benefit the every day hard working people and not the big banks.

'Don’t let Australia become controlled even more – we do want a cashless society.'

The south east Queensland mechanics said it forked out around $400 per month to take digital payments

RMIT University finance academic Angel Zhong has previously suggested Australia will become a functionally cashless society by 2030,earlier than the Commonwealth Bank's forecast of 2026.

Functionally cashless,she explains,means digital payments make up more than 90 per cent of total payments,although cash would retain its value and not disappear.

Her calculation is based on consumer preference data from the RBA.

The latest 2022 survey,published in June 2023,shows cash made up 13 per cent of total payments,down from 69 per cent in 2007 and 27 per cent in 2019.

Reserve Bank of Australia Governor Michele Bullock warned in December the declining circulation of cash was putting pressure on the economics of ATMs and physically moving notes and coins around.

She even suggested businesses could start to push those costs onto consumers by charging extra to use cash.

Home or Away Mechanical Services has been contacted for comment.

QueenslandMicrosoft